All Categories

Featured

Table of Contents

Keep in mind, nonetheless, that this does not state anything about changing for rising cost of living. On the bonus side, also if you presume your choice would be to spend in the supply market for those seven years, which you 'd get a 10 percent yearly return (which is far from specific, especially in the coming years), this $8208 a year would be greater than 4 percent of the resulting small stock worth.

Example of a single-premium deferred annuity (with a 25-year deferment), with 4 payment choices. Politeness Charles Schwab. The monthly payout below is highest possible for the "joint-life-only" option, at $1258 (164 percent greater than with the instant annuity). Nonetheless, the "joint-life-with-cash-refund" option pays just $7/month less, and assurances at the very least $100,000 will certainly be paid.

The method you purchase the annuity will certainly figure out the answer to that inquiry. If you get an annuity with pre-tax bucks, your costs minimizes your taxable revenue for that year. Ultimate settlements (month-to-month and/or lump sum) are exhausted as normal income in the year they're paid. The advantage here is that the annuity may let you delay tax obligations beyond the IRS contribution limits on IRAs and 401(k) plans.

According to , purchasing an annuity inside a Roth strategy results in tax-free payments. Buying an annuity with after-tax bucks outside of a Roth leads to paying no tax on the part of each repayment connected to the original costs(s), however the remaining part is taxable. If you're establishing up an annuity that starts paying before you're 59 years old, you might have to pay 10 percent early withdrawal penalties to the IRS.

What is an Tax-deferred Annuities?

The expert's primary step was to create a thorough financial prepare for you, and after that explain (a) just how the proposed annuity matches your overall strategy, (b) what options s/he thought about, and (c) exactly how such alternatives would or would certainly not have led to lower or higher settlement for the consultant, and (d) why the annuity is the premium option for you. - Deferred annuities

Certainly, an expert may attempt pressing annuities even if they're not the most effective suitable for your situation and objectives. The reason might be as benign as it is the only product they offer, so they fall victim to the proverbial, "If all you have in your tool kit is a hammer, quite soon everything begins resembling a nail." While the expert in this scenario may not be unethical, it increases the risk that an annuity is an inadequate option for you.

How do I apply for an Tax-efficient Annuities?

Because annuities often pay the agent selling them much higher compensations than what s/he would get for investing your money in common funds - Income protection annuities, let alone the zero commissions s/he would certainly get if you spend in no-load common funds, there is a large incentive for representatives to press annuities, and the a lot more challenging the far better ()

A deceitful expert suggests rolling that quantity into new "far better" funds that simply happen to lug a 4 percent sales tons. Agree to this, and the expert pockets $20,000 of your $500,000, and the funds aren't likely to execute better (unless you selected a lot more poorly to start with). In the exact same instance, the expert can guide you to purchase a challenging annuity with that $500,000, one that pays him or her an 8 percent commission.

The expert hasn't figured out how annuity settlements will certainly be strained. The consultant hasn't disclosed his/her compensation and/or the fees you'll be charged and/or hasn't shown you the influence of those on your eventual payments, and/or the compensation and/or costs are unacceptably high.

Your family members background and current wellness indicate a lower-than-average life span (Annuities for retirement planning). Current rates of interest, and hence forecasted repayments, are traditionally low. Also if an annuity is ideal for you, do your due persistance in contrasting annuities offered by brokers vs. no-load ones offered by the releasing business. The latter may need you to do even more of your own research study, or make use of a fee-based financial consultant that may obtain compensation for sending you to the annuity issuer, but might not be paid a higher compensation than for various other investment options.

Annuities For Retirement Planning

The stream of month-to-month payments from Social Safety is similar to those of a deferred annuity. Since annuities are voluntary, the individuals buying them typically self-select as having a longer-than-average life span.

Social Protection advantages are totally indexed to the CPI, while annuities either have no inflation protection or at a lot of supply a set percentage yearly boost that may or might not make up for inflation in full. This kind of biker, as with anything else that enhances the insurance firm's danger, needs you to pay even more for the annuity, or approve lower settlements.

How do I cancel my Annuity Payout Options?

Please note: This article is planned for educational objectives just, and need to not be thought about financial recommendations. You must get in touch with an economic expert prior to making any major economic decisions.

Considering that annuities are intended for retirement, taxes and penalties might use. Principal Protection of Fixed Annuities.

Immediate annuities. Used by those who desire reliable revenue quickly (or within one year of acquisition). With it, you can customize earnings to fit your requirements and develop earnings that lasts forever. Deferred annuities: For those that wish to expand their money with time, however agree to defer accessibility to the cash till retirement years.

What is the process for withdrawing from an Annuity Withdrawal Options?

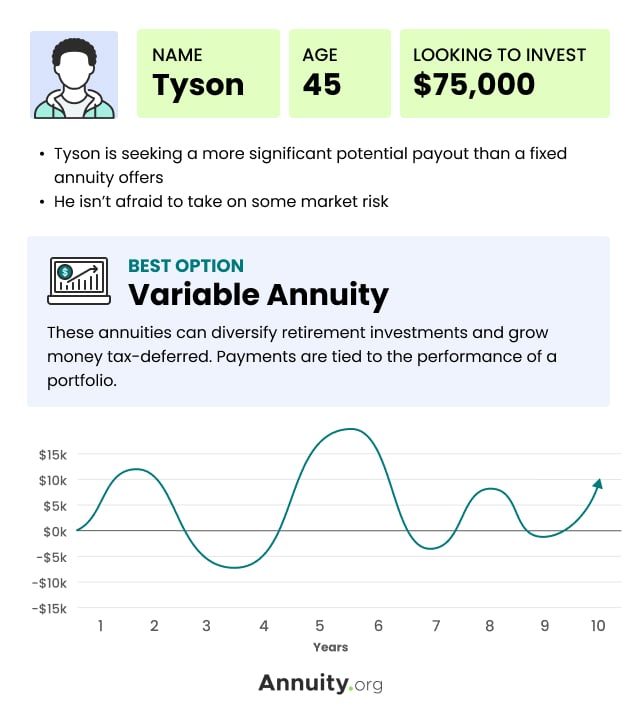

Variable annuities: Supplies better potential for development by spending your cash in investment choices you select and the capability to rebalance your profile based upon your choices and in such a way that lines up with changing financial goals. With fixed annuities, the business invests the funds and offers a rates of interest to the customer.

:max_bytes(150000):strip_icc()/FutureValueofanAnnuity_final-05f2d1d9409646adb05be26c49787a26.png)

When a death claim accompanies an annuity, it is essential to have actually a called recipient in the contract. Various options exist for annuity death advantages, depending upon the contract and insurance company. Choosing a reimbursement or "duration specific" choice in your annuity provides a death benefit if you die early.

What does an Annuity Interest Rates include?

Naming a beneficiary various other than the estate can aid this process go extra smoothly, and can help make certain that the profits go to whoever the specific wanted the money to go to instead than going with probate. When existing, a death advantage is immediately consisted of with your contract.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments A Closer Look at Tax Benefits Of Fixed Vs Variable Annuities Defining Variable Annuity Vs Fixed Annuity Features of What Is Variable Annuity Vs F

Analyzing Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Deferred Annuity Vs Variable Annuity Defining the Right Financial Strategy Features of Smart Investment Choices Why Choosing the Ri

Breaking Down Pros And Cons Of Fixed Annuity And Variable Annuity A Comprehensive Guide to Investment Choices What Is Fixed Income Annuity Vs Variable Growth Annuity? Benefits of Fixed Annuity Or Vari

More

Latest Posts